Q2 2024

July 16, 2024

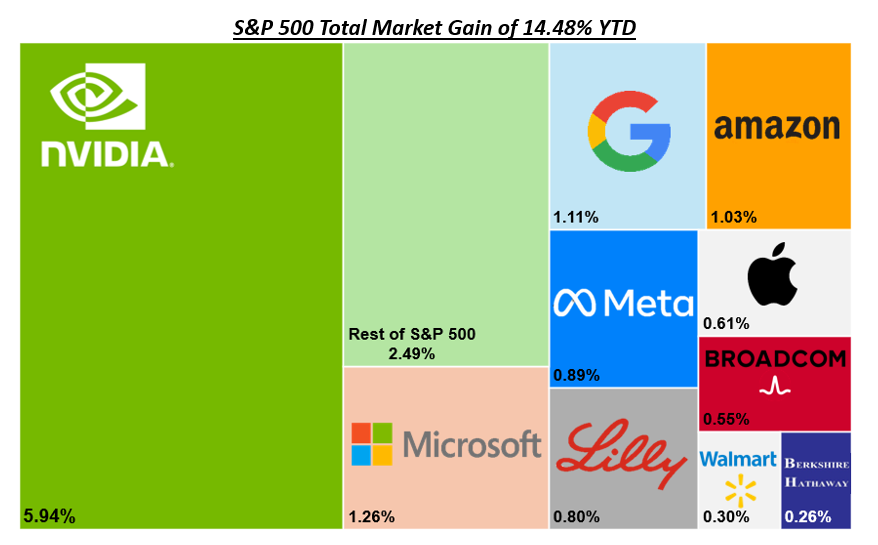

The S&P 500 advanced another 4.32% this quarter, bringing its year-to-date gain to 14.48%. The ongoing enthusiasm for AI continues to fuel momentum, leading to premium valuations for select companies with compelling AI narratives. As the fascination with AI intensifies, financial markets suggest a perceived lack of future competition in the space, with mega-cap technology companies driving overall market returns (See Chart).

Figure 1

Consequently, the S&P 500 remains historically concentrated and on trend. The top 10 companies (Microsoft, Apple, NVIDIA, Amazon, Meta Platforms, Alphabet, Broadcom, Berkshire Hathaway, Eli Lilly, and Tesla) currently account for nearly 30% of the index’s market capitalization. As shown on the next page, today's extreme levels of concentration have only been surpassed once in the post-war era.

Figure 2

In the early 1960s, investor enthusiasm for steel, automotive, and oil companies led to a high level of index concentration. Companies like GM, Exxon Mobil, and U.S. Steel greatly increased productivity, transformed society, and sparked a new wave of American exceptionalism. Today, AI holds similar transformative potential. However, the top companies of the 1960s eventually saw their returns lag behind the rest of the market as competitors emerged and commoditized their industries. This rivalry transferred value from these industries to the broader economy, reducing market concentration.

Similar competitive dynamics may unfold in the realm of artificial intelligence. If the technology meets its highly anticipated potential, competitors will likely enter the industry from all directions. This increased competition would drive down prices for AI products and services, benefiting the broader economy. Such a transfer of value from select industries and companies could once again reduce market concentration. As Jim Grant of Grant’s Interest Rate Observer aptly states, “Progress is cumulative in science and engineering, but cyclical in finance.”

Overall, market dynamics in the second quarter underscored the importance of maintaining discipline in our investment approach. The fluctuations of trending sectors can fuel a fear of missing out, tempting many investors to deviate from companies with strong business models, attractive valuations, and sound portfolio management principles. While this disciplined approach may not always seem the most appealing at any given moment, we remain committed to its long-term viability and performance.

Sincerely,

Janet Wills

Adam Mehrer